Mitigating risk to pension plan members and sponsors during an annuity purchase

PRT Insights – March 2023

The protection of member pension benefits is vital to both plan sponsors and regulators when exploring risk transfer from a defined benefit pension plan through an annuity purchase. Mitigation of insurer insolvency risk can be achieved through various approaches, including Assuris coverage, insurer tranching, and annuity discharge.

In Canada, if an insurer becomes insolvent, Assuris, a not-for-profit organization funded by life insurers, protects annuitants by facilitating the transfer of policies from the insolvent insurer to another insurer.

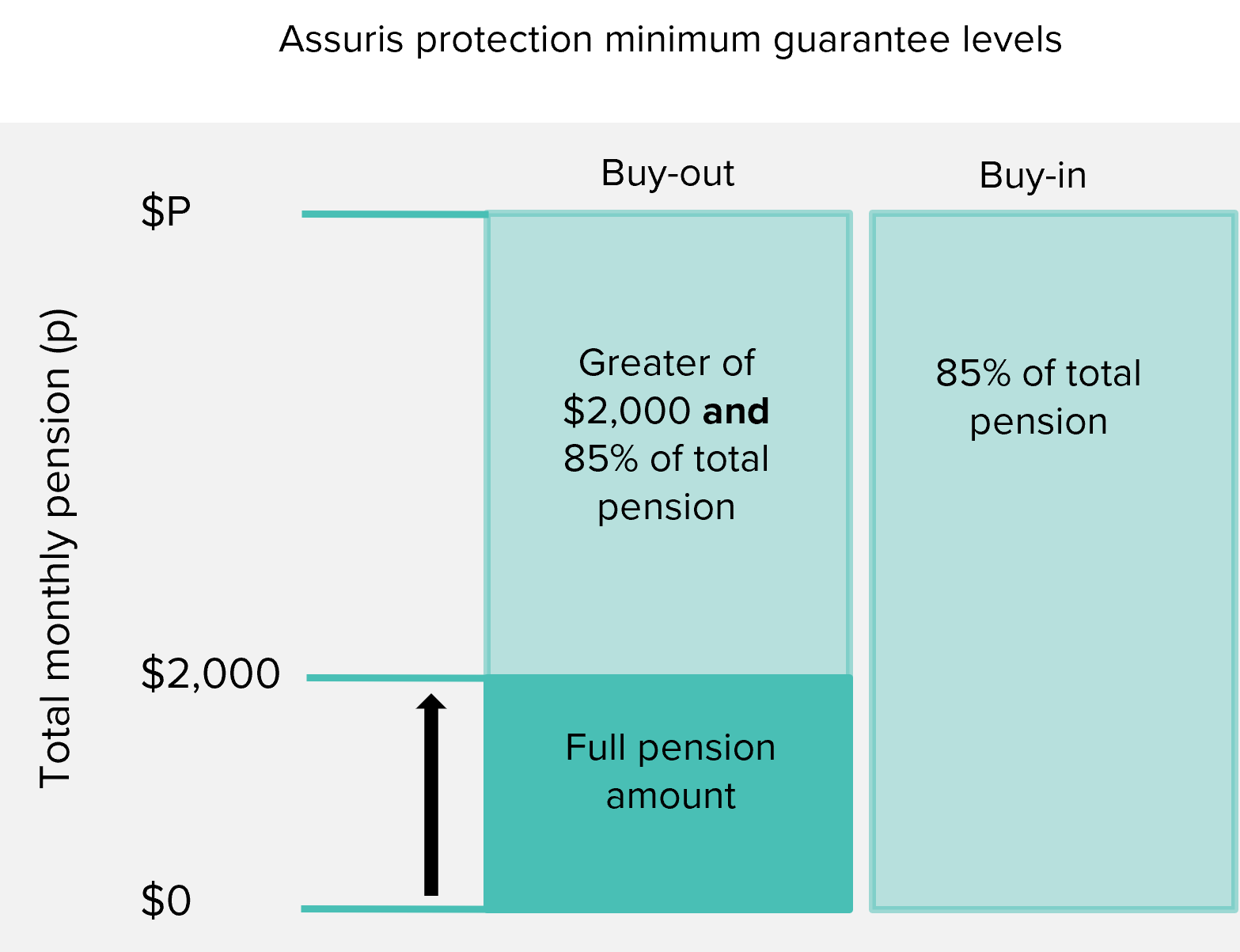

Assuris provides slightly different coverage depending on whether the annuity was purchased as a buy-out or as a buy-in annuity.

In the case of buy-out annuities, where an insurer directly pays member pensions, Assuris provides protection for members’ pension benefits with a guarantee of their full monthly pension income if the amount is less than $2,000 per month; otherwise, members receive the greater of $2,000 per month and 85% of the monthly income promised by the insolvent insurer.

For buy-in annuities, where an insurer pays the pension plan, and the plan pays member pensions, the coverage is 85% of the total pensions covered (or 85% of each annuitant’s pension benefit). While Assuris guarantees a set level of minimum coverage, the liquidation of an insolvent insurer may result in higher benefits.

For transactions where there are annuitants with monthly pensions in excess of $2,000 per month, we often suggest that the pension benefits be “tranched.” This means that the pension benefit may be split between two or more insurance companies to increase (and where possible, maximize) Assuris coverage for members’ benefits.

Tranching should also be considered where there is a need to manage insurer capacity limits when the total transaction size is large, or when the annuitant group is non-homogeneous in demographic profile or features. In these cases, tranching can allow each annuity provider to provide their best quote on the piece of business that best fits their target profile in addition to providing more layers of Assuris coverage.

One of the other significant benefits of tranching is the enhanced protection provided to plan sponsors. In an ongoing pension plan, a plan sponsor is not discharged from liabilities, even when annuities are purchased, unless the requirements for a formal discharge have been met. While rare, it means that plan sponsors can be required to fund any shortfall in annuities not covered by Assuris on insurer insolvency. This is referred to as “boomerang risk.”

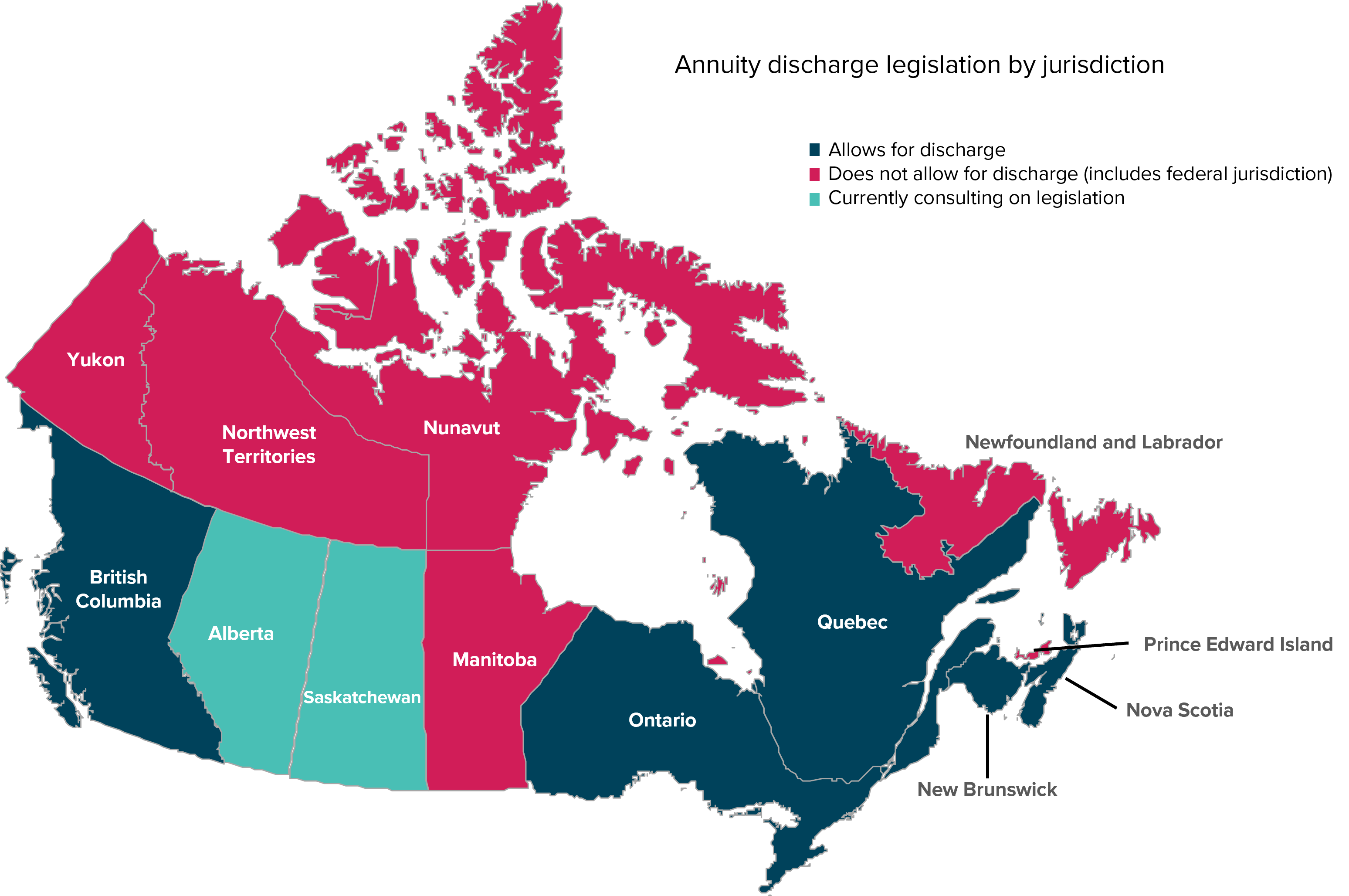

Several provinces in Canada now allow for discharge of obligations for pensioners and deferred vested member liabilities when plan sponsors purchase buy-out annuities to mitigate against boomerang risk.

If a pension plan is registered in one of these jurisdictions, and the annuity purchase meets applicable conditions, the plan sponsor can apply for a discharge of the liabilities to eliminate its boomerang risk. Nova Scotia, Ontario, and Quebec have a formal application process for an annuity discharge, but in provinces such as British Columbia and New Brunswick, the plan sponsor is deemed to be discharged only if all regulatory conditions have been met.

Working strategically with plan sponsors and annuity providers to optimize risk mitigation through Assuris and legislation will add more layers of protection for members and sponsors and can result in more favourable annuity pricing.

To speak with one of our pension risk transfer experts, click the button below.

This article has been prepared for general information purposes only and does not constitute professional advice. Eckler makes no representations or warranties with respect to the accuracy of the information. Nothing in this report should be construed as investment, legal or any other type of professional advice. Eckler is not responsible for the consequences of any use of the information presented in this report and does not accept any liability for errors, inaccuracies or omissions.