Lower rewards for managing interest rate risk

Quebec introduces draft Regulation to amend

Regulation respecting supplemental pension plans

Special Notice – July 16, 2019

On July 3, 2019, the government of Quebec published draft regulation (Regulation) amending the Regulation respecting supplemental pension plans in the Gazette officielle du Quebec. The Regulation proposed to amend the scale used to determine target levels with respect to stabilization contributions applicable to private-sector pension plans, as well as additional changes highlighted below.

Target Levels of Stabilization Provisions

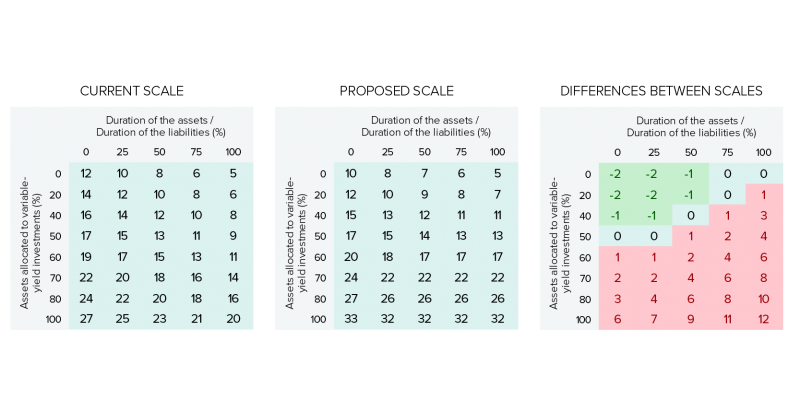

The most significant change proposed by the draft Regulation is the revision of the scale used to determine the target level of the stabilization provision that must be established and funded, when applicable, by the payment of stabilization contributions. The target level of the stabilization provision is determined in the manner prescribed by regulation, and is based on the long-term asset mix targets set out in the pension plan’s investment policy. The following charts illustrate the current and the proposed scales, and outline the differences:

Eckler’s Opinion: The current scale has allowed, when compared to the previous funding rules as they read before January 1, 2016, plan sponsors and administrators to turn their focus to establishing long-term integrated investment and funding policies that reflected a plan’s characteristics and aligned with the long-term funding objectives of the plan sponsors. As a result, some plans have improved their match between assets and liabilities, or increased their exposure to return-seeking investments to improve long-term expected returns.

The proposed revised scale will not have a significant impact on typical plans,

i.e., plans with 40% to 60% of their assets invested in fixed-income investments and a ratio of durations between 25% and 50%, with the target level of the stabilization provision changing by -1% to +2%.The proposed scale, however, will penalize plans for privileging a strategy with more variable-yielding investments over the long term, especially plans where assets are matched to liabilities using derivative products. For example, a plan with a 60% allocation to variable-yielding investments that has fully matched its liabilities using derivatives would see its stabilization provision target level increase from 11% to 17%, which represents a 55% increase. This change alone would result in a significant increase in required contributions for the plan.

However, the proposed effective date of December 31, 2019 will be a partial relief to plan sponsors and administrators, as it will allow time to analyze and potentially revisit recent investment strategies made after the release of the current scale. Plan sponsors will need to carefully review the impacts of proposed changes with their consultants, and make the appropriate decisions to realign their investment and funding objectives with their risk budget. Plans with a cost-sharing agreement should also take a proactive approach to communicating changes to plan participants.

Allowance for Consideration of Unquoted Private Debts

The Regulation will also allow for unquoted private debts to be considered, up to 10% of plan’s assets, as fixed-income investments under certain conditions for the determination of the target level of the stabilization provision. This is a welcome change for plan sponsors, as it will allow for a better diversification of the fixed-income portfolio of the plan and result in the reduction of the target level of the stabilization provision.

Limits on Fees Associated with AIRs and Other Filings

The Regulation also proposed to increase the upper limit of fees required when filing annual information returns (AIRs), registering a pension plan, or filing a termination report from $100,000 to $150,000 effective December 31, 2019, and indexed annually thereafter. Plans with significant numbers of members may see increased fees based on the proposed adjustment.

Relief Regarding Content of Partial Valuations and Fees for Document Filing

The Regulation proposed various reliefs with respect to the content of partial valuations related to amendments and annuity purchases for private-sector pension plans. In addition, it is proposed that additional fees payable for delays in filing reports in certain situations be eliminated.

Next Steps

Retraite Quebec will accept comments on the proposed Regulation for 45 days following publication in the Gazette officielle du Québec, after which the Regulation will be submitted to the government for approval.