Much Ado About Voting: Why Canadian Investors Shouldn’t Sweat the US Election

Investment Brief – October 2024

The issue in brief

- Over 70 countries are going to the polls in 2024, including the United States.

- Equity index returns are primarily driven by macroeconomic factors such as inflation, interest rates and economic conditions. US equity returns in election years are similar to non-election years.

- Equity markets dislike uncertainty, and an uptick in equity market volatility may occur in the weeks leading up to the election date. However, this volatility tends to dissipate quickly post-election, regardless of the party elected.

- Policy outcomes of elections may impact individual sectors, geographies or companies and these asset-level impacts may be considered by active managers.

Impact on clients

- For investors with a long-term time horizon, short-term events such as elections should not direct long-term strategic asset allocation. However, awareness of shorter-term events can help facilitate discussions with investment managers on positioning and market outlook as well as preparing investors to stay the course through any short-term market volatility.

Over half of the world’s population will be heading to the polls in 20241, and arguably the most closely watched of those contests will be the November 5th US presidential election.

The US is home to a significant percentage of the investments held by Canadian institutional investors.

The US equity market comprises nearly 2/3 of global equity market capitalization2 and is a core market for alternative asset classes such as private debt, private equity and real assets.

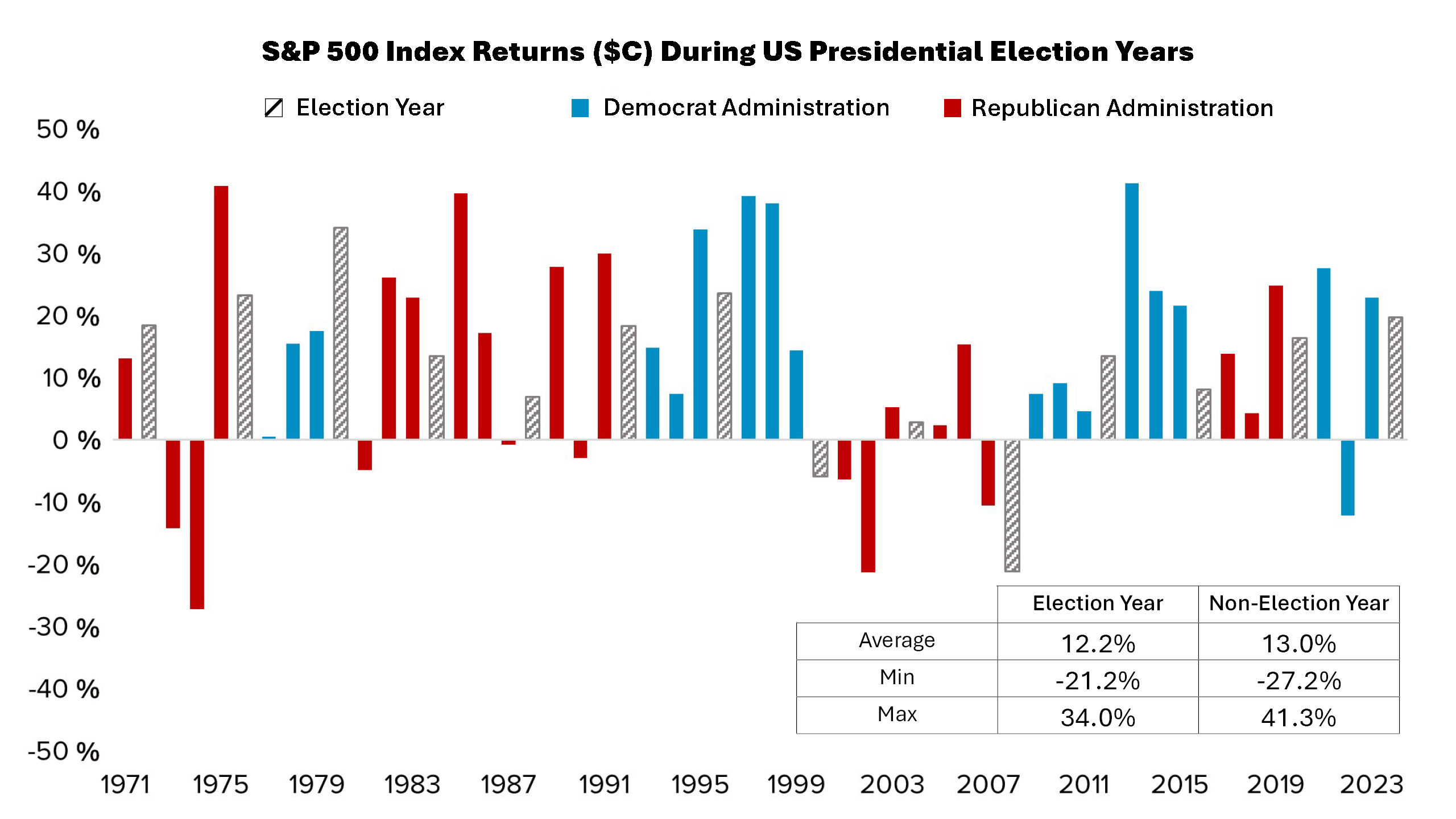

Over this period, presidential election year returns have averaged 12.2%, similar to the total S&P 500 average return of 12.8%. Moreover, both election and non-election years have seen double-digit index gains – as well as double-digit losses.

This data shows us that overall market returns tend to be driven by macro economic factors such as inflation, interest rates, and economic conditions, rather than political races.

Equity markets do not ignore elections entirely

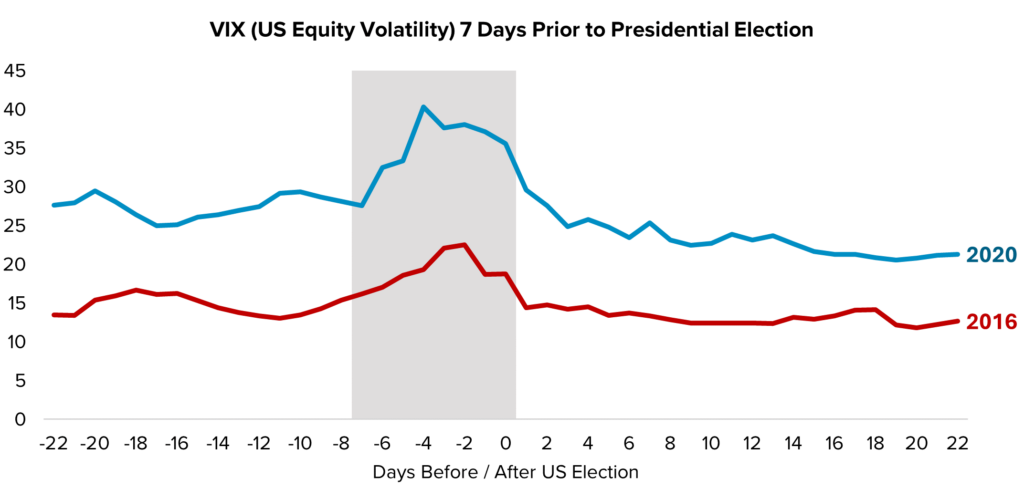

One equity market indicator that does appear to be affected by the presidential election cycle is market volatility. In particular, US equity markets have tended to exhibit elevated VIX3 readings in the week preceding an election.

Interestingly, this elevated volatility is most pronounced preceding elections which result in a switch of elected party between Democrat and Republican – or vice versa.

However, this implied volatility is short-lived and typically reverts to normal levels once the election has passed. This suggests that markets are more impacted by pre-election uncertainty than the election result for any particular party or candidate.

Policy decisions may impact individual investment returns

Political policy decisions may impact individual investments through several levers post-election:

For investors that employ active management these policy factors may be incorporated into asset-level valuation or in the development of top-down macro views.

Stay the course but prepare for bumps ahead

For investors with a long-term time horizon, short-term events such as elections should not direct long-term strategic asset allocation. However, awareness of shorter-term events can help facilitate discussions with investment managers on positioning and market outlook as well as preparing investors to stay the course through any short-term market volatility.

1According to The Economist, elections will be held in over 70 countries that are home to 4.2 billion people. Outside the US election, other closely watched elections include India, Mexico and the European Parliament.

2Based on MSCI ACWI Index country weights as of July 31, 2024. The weight of the US equity market has risen substantially over the past decade, due to strong performance relative to other regions. In the late 1980’s, the US comprised only a third of global equity market capitalization.

3The VIX is a measure of expected market volatility as implied by trading prices of options on the S&P 500 Index.