New research says Canadians are expected to live longer. What does that mean for your defined benefit pension plan?

A quintessential element of the work of actuaries is the analysis of mortality rates. Mortality rates can be bucketed into baseline mortality rates (i.e., current mortality rates) and mortality improvement rates (i.e., how mortality rates are expected to change in the future). Given that mortality is a key assumption when valuing DB pension obligations, the recently released Canadian Institute of Actuaries (“CIA”) report with results of a multi-year research project into Canadian mortality improvement (“MI”) rates is big news in Canadian actuarial circles.

The new mortality improvement scale released in the report provides pension actuaries another choice for their actuarial valuations and, while its release is big news for pension actuaries, it is also significant for DB pension plan sponsors who might naturally question the impact of the new scale on their plans. The first in a two-part series, this article will explore those potential impacts. In the second article we will take a look at the considerations for choosing the right MI assumption for the valuation of a particular pension plan.

The alphabet soup of mortality improvement scales: CPM-B, MI-2017, APCI

Mortality rates are generally assumed to decrease (i.e., improve) over time, which is reflected by incorporating a MI scale. For example, a 65-year-old person 20 years in the future is expected to live longer than a 65-year-old person today. Mortality rates have a long history of improving due to various factors – advancements in sanitation, healthcare and medical treatments, economic prosperity and lifestyle habits among them.

The CPM-B (introduced in 2014) and MI-2017 (introduced in 2017) scales are the two most commonly used for Canadian DB pension plans today. The new research has introduced a few more letters to the soup: the APCI1 scale. A key difference between the three scales is the long-term MI rates. The table below shows the long-term MI rates for each scale and the potential increase in life expectancy (or more specifically, cohort life expectancy) at age 65 if adopting the new APCI scale.

| MI scale | Year of release | Long-term MI rate2 | Approximate increase in life expectancy at age 653 if adopting APCI scale |

| CPM-B | 2014 (with the CPM baseline mortality tables) | 0.8% starting in 2030 |

Males: +1.1 years Females: +1.4 years |

| MI-2017 | 2017 | 1.0% starting in 2033 |

Males: +0.8 years Females: +0.9 years |

| APCI | 2024 | 1.3% starting around 2050 | N/A |

1 APCI stands for Age-Period-Cohort Integrated and means the MI scale accounts for how mortality improvements vary by age, over periods of years and by the year someone was born (i.e., birth cohort).

2 Long-term MI rates grade down to zero at older ages for the three MI scales, albeit differently, and the APCI has a long-term MI rate of 1.0% under age 40.

3 Based on 2014 baseline Mortality Table (CPM 2014).

The APCI scale’s long-term MI rate is 63% higher than that for CPM-B and 30% higher than that for MI-2017. A higher long-term MI rate lowers future mortality rates and increases life expectancy, as shown in the last column of the table. While the increases in life expectancy may not look that large, they are quite significant. Here’s why: Period life expectancy at age 65 for males in Canada increased by approximately one year over the 10-year period ending in 2019. That means it took 10 years for the period life expectancy of a 65- year-old to increase one year. Adopting the new MI scale is like reflecting 10 years’ worth of increases in life expectancy all at once.

Impact on going-concern and accounting pension plan liabilities

If the APCI scale is adopted as published, the higher life expectancy will result in an increase in pension liabilities. The impact to going-concern and accounting liabilities will depend on various factors:

|

A plan’s demographic profile

|

The age profile of the plan membership, as well as the male / female composition. All else being equal, the impact is generally greater for a younger population. |

|

Current baseline mortality assumptions

|

The impact of changing from CPM-B is greater than changing from MI-2017. In addition, the increase will be different depending on the current baseline mortality tables used. |

|

Discount rate

|

The lower the discount rate, the greater the liability increase. |

|

Plan’s indexation provision

|

If pensions increase with inflation, the impact will be greater. |

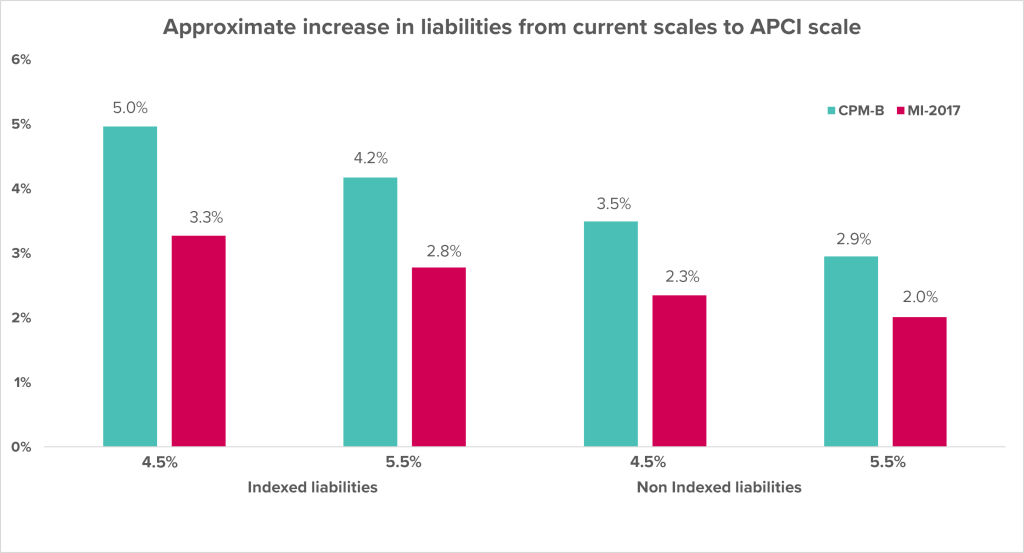

The graphs below show the potential impact of replacing a current MI scale (either CPM-B or MI-2017) with the APCI scale for a hypothetical pension plan1. Impacts are shown for different discount rates as well as with and without post-retirement indexation.

As we noted earlier, the actual impact of adopting the APCI scale will depend on the characteristics of the particular plan. For example, the impact for a plan with a higher proportion of active members will be greater than for a plan with a higher proportion of retired members. To get the actual impact of adopting the APCI scale for your plan(s), your actuary would need to “run the numbers”.

Impact on wind-up and solvency liabilities

In addition to going-concern and accounting liabilities, wind-up and solvency liabilities may change as well. However, the impact is more difficult to assess for a couple of reasons:

- Wind-up and solvency liabilities are divided between those that are assumed to be settled by the payment of a lump sum commuted value and the purchase of a group annuity.

- Lump sum values are generally calculated using prescribed assumptions, including prescribed mortality assumptions – currently the CPM 2014 mortality table with MI scale CPM-B. For most plans, these prescribed assumptions would need to change to use a different MI scale for lump sum liabilities. The CIA is also working on updating the baseline mortality tables used in calculating lump sum values. We believe it is unlikely that the prescribed mortality assumptions would be revised until the work on new mortality tables is completed (currently not expected until 2025.)

- Liabilities assumed to be settled by a group annuity may or may not change significantly given that annuity purchase assumption guidance is ‘reverse-engineered’ based on actual annuity purchases rather than a prescribed table. However, if insurance companies revise their assumptions in response to the new MI research (or for other reasons), then annuity purchase liabilities may increase as well. Currently, several insurers incorporate MI rates that rely on the MI-2017 scale to calculate their reserves for accounting and regulatory purposes but some may already be using different MI assumptions for both pricing and valuation.

Other important questions

Measuring the liability impact of adopting the new APCI scale is relatively straightforward for actuaries, excluding the uncertainties noted above regarding wind-up and solvency liabilities. The more challenging question is: what is the right MI assumption for my plan? Canadian pension actuaries have tended to use a small number of MI scales (today, either CPM-B or MI-2017), but given the large uncertainty around how long people will live in the future and the different factors influencing current and future mortality, does a one-size-fits-all approach make sense? We will delve into these and other questions in the follow-up to this article.

What is the right MI assumption for my plan?

If you have any questions about this or other important topics, please reach out to your Eckler consultant or connect with us at Eckler.ca.

1 Salary-related plan, with approximately 45% active plan membership. Where applicable, post-retirement pension increases are 2.0% per year. Baseline mortality based on the CPM 2014 Private mortality table.