Prudence and care: ensuring fiduciary responsibility with asset mix reviews

One of the fiduciary duties of institutional investors is using prudence and care in managing the investments of their beneficiaries. Assessing portfolio cash flows, budgeting, and planning for the portfolio’s risk/return objectives are central to that responsibility.

Asset allocation is widely considered the largest determinant of risk and return in a portfolio. It is also highly sensitive to market conditions and, as such, managing the asset allocation so that it continues to meet fund objectives is critical. The rise in inflation and interest rates over the past five years, as well as recent economic turmoil as a result of current (and threat of future) US tariffs on Canadian goods, serves as an important reminder of the market conditions that might impact the target risk/return objectives.

Trigger warning!

No, not that kind of trigger warning but a trigger none the less because there are many factors that can trigger the need to ensure that the fund’s asset allocation will continue to meet fund objectives under different economic scenarios.

Internal factors: These factors are generally within the control of the institutional investor and include changes in assumptions and objectives. Changes in assumptions can include the magnitude, timing or certainty of cash flows, and the investment time horizon. Changes in objectives can include the intended use of assets, metrics used to evaluate the success of the portfolio and change in the organization’s risk appetite.

External factors: These are factors that are beyond an investor’s control. These may include regulatory changes and changes in the market and economy. These can include changes to regulatory funding rules, changes in capital market assumptions, market rallies or drawdowns, a new asset class that is available for consideration, or even nonsensical tariffs from your neighbour!

In addition to internal or external changes in the environment, periodic testing of the current asset mix to ensure it remains optimized should also be considered a routine part of a good governance process.

A more comprehensive analysis

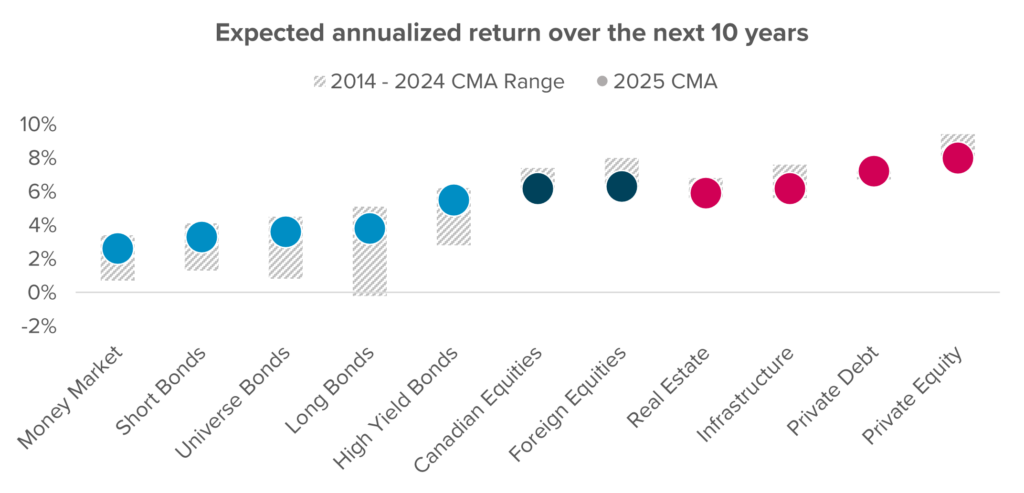

The chart below illustrates the expected return under Eckler’s capital market assumptions for the major asset classes for the next 10 years, plotted against the range of expected returns for historic Eckler capital market assumptions over the past 10 years. Eckler regularly updates assumptions for 50+ asset classes. They are updated annually or more frequently if capital market conditions change.

Key observations:

- Long term fixed income return expectations have varied more year over year relative to the equity and alternative asset classes;

- Long term fixed income returns are expected to be more attractive than in the past, primarily driven by the higher starting yields going into 2025;

- Although classified as an alternative investment, private debt also remains attractive relative to its private equity counterpart because of the higher floating rate yields; and

- Long term equity returns are expected to be higher than fixed income returns but are lower than in past years, driven by higher starting valuations going into 2025.

While the above table shows the expected return for the different asset classes, capital market assumptions generally run thousands of forecasts for different asset classes under different economic scenarios. While the expected return of an asset class is important, so too is its volatility and correlation to other asset classes because it ensures a more robust understanding of how asset mixes perform under different economic conditions.

Project and compare with a view to the horizon

Asset allocation decisions are generally made with a longer-term outlook, and it is generally recommended that institutional investors consider the horizon of their investments and not make reactionary asset allocation changes based on market events and market timing. However, as previously noted, capital market assumptions can provide insight into how a current asset mix or asset mix changes will be impacted by economic scenarios.

While the situation has been changing week to week, and sometimes even day by day, there has been a lot of volatility in the market due to US threat of tariffs. As a result, the Bank of Canada expects higher inflation with lower economic growth (know as a “stagflation economy”). The magnitude and impact of these expectations will change depending on many factors, including:

- The duration of the tariffs;

- The extent and duration of retaliatory measures;

- Foreign exchange movements;

- Fiscal response;

- Central bank response; and

- Changes to business consumer sentiment.

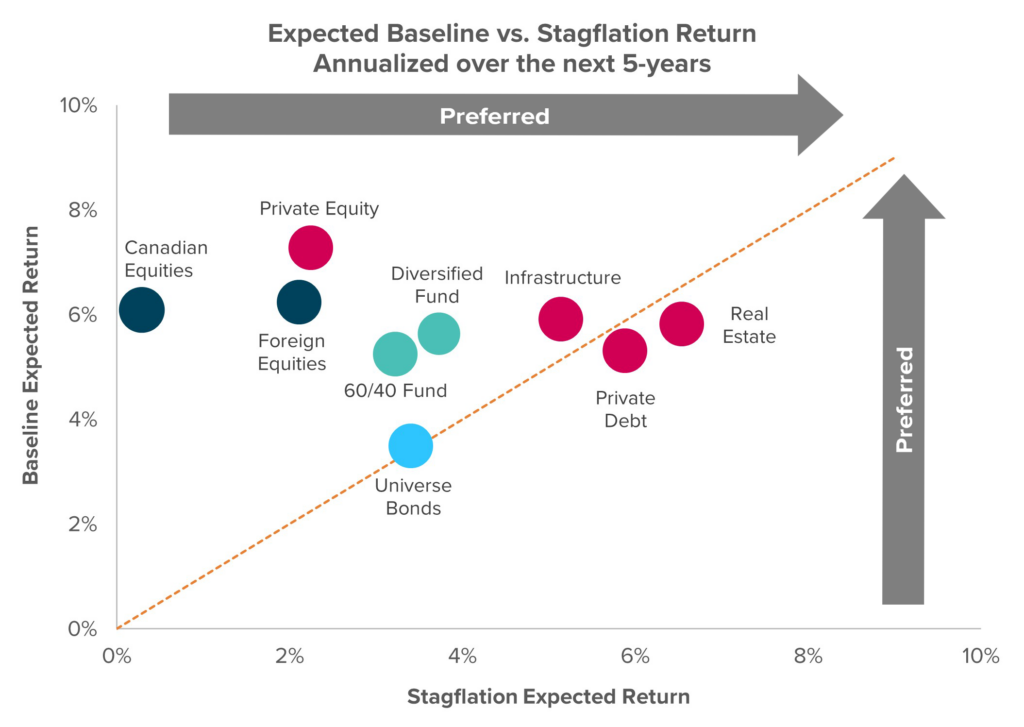

The chart below revisits the expected returns of some asset classes (annualized over a 5-year period) and also looks at the 5-year expected return of these asset classes in a three-year stagflation economy. The chart also includes the expected returns of two portfolios: one portfolio with a classic 60%/40% equity/fixed income split, and one with a more diversified mix of 30%/40%/30% split between equities/fixed income/alternatives.

We can see from the chart above the benefits of diversification through the addition of asset classes that are less correlated to bonds and equities. By adding alternative investments into the asset mix, the portfolio will be better protected in a stagflation economy.

Building resilience for turbulent times

As capital market assumptions change and markets develop over time, investors may make changes to the asset mix of their portfolios. In fact, over the past few decades, the asset allocation of portfolios has evolved as new asset classes have become available – real estate, infrastructure, private credit and private debt among them. Over the past five years portfolios have continued to evolve as economic markets have shifted. For example, as interest rates have risen with increased inflation, portfolios have shifted away from equities to fixed income. Investments also continue to flow into private markets as they become more accessible for institutional investors.

As economist John Maynard Keynes is widely attributed as saying, the market can remain irrational longer than you can remain solvent. Even with sound investment based on rational analysis, the market may take a direction that defies expectations. The past few years, and indeed the past few weeks, is proof of that reality. The good news is, even in turbulent economic times, there are tools to help institutional investors continue to use prudence and care in managing the investments of their beneficiaries.

Understanding how an asset mix will react to different economic scenarios is critical to meeting current objectives and buffering against future shock. By integrating capital market assumptions with investor-specific needs and maintaining a disciplined review process, institutional investors can build resilient portfolios that adapt to changing market conditions and continue to meet long-term investment goals.