The “new norm” and what to do about it

The “new norm” and what to do about it

Capital Accumulation Plan Income Tracker (CAPit) – August 2019

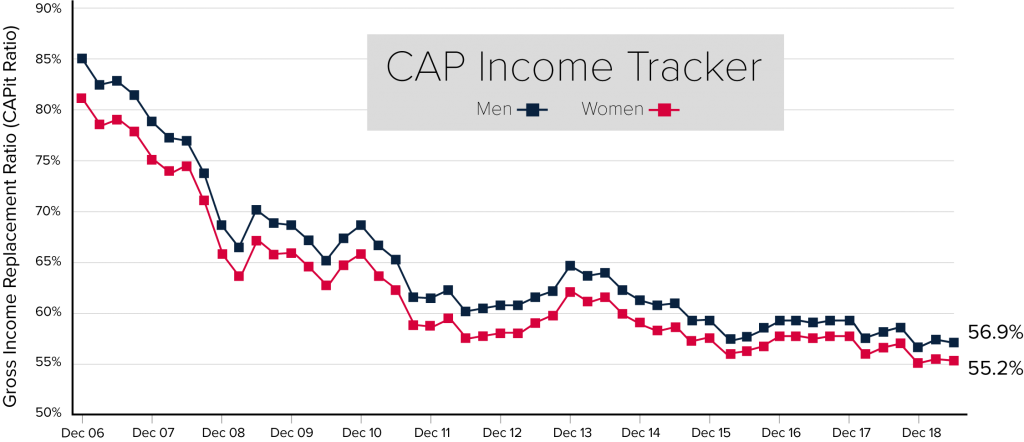

At June 30th, the news wasn’t any better for Canadians looking to replace working income from a CAP and government benefits. Gross replacement income fell back to 55% for females and 57% for males, while equity and bond markets yielded marginal positive returns and annuity rates fell. Is this the “new norm”? What do we do about it?

Many of our current retirement systems and beliefs are based on factors that have changed considerably over the years: the decades-long decline of long-term interest rates, and our increasing longevity, for example. Today, on average, a 65-year-old can expect to live to age 88 for a male and 90 for a female. These fundamental changes mean that old “rules of thumb,” like saving 10% (the rate used in our CAP Income Tracker), are simply not going to lead to the same outcomes as they did before.

What can you do about it? The first step is always acknowledgement. We need to understand that this is the “new norm,” and using outdated rules will lead to unexpected and unwanted outcomes. While it’s important for plan sponsors, and the industry in general, to acknowledge this, we must also get this message through to employees.

Increasingly, employees are the ones responsible for making a host of financial decisions about their retirement savings and must bear the consequences of those decisions. Making sure employees understand how much they will need in retirement, and the required savings to get there, are critical pieces of information that you can provide for them.

We should move away from old “rules of thumb” that are no longer relevant or accurate. We can see in the Income Tracker that saving 10% certainly doesn’t provide the same replacement income it used to. So how much do your members need? As Bonnie-Jeanne MacDonald – Resident Scholar at Eckler, and Senior Research Fellow Director of Financial Security at the National Institute on Ageing (Ryerson University) – has proven, using the 70% replacement rule can also be problematic.

Finding ways to provide your employees with the knowledge they need to achieve their financial goals is vital to ensuring they are less stressed during their savings years and are prepared to retire on time. Ignoring the “new norm” could lead to expensive consequences for plan sponsors.

About the CAP Income Tracker

The CAP Income Tracker assumes the member made annual contributions at a rate of 10% starting at

age 40, will receive maximum Old Age Security and Canada/Quebec Pension Plan payments, and will

use their CAP account balance at retirement to buy an annuity. The member’s CAP account is invested based on a balanced strategy. Salary has been adjusted annually in line with changes in the average industrial wage, and is set at $66,691 at June 30, 2019.